ABOUT POLARIS

For 30+ years, we have been steadfast in our belief that a global value investing strategy achieves top risk-adjusted returns. The proof is in our benchmark-beating performance.

-

- LENGTHY TRACK RECORD: We have one of the longest global and international track records of any firm presently in operation and continuously managed by the same individuals.

- VALUE-ORIENTED: We believe our success is attributable to the consistent and disciplined adherence to the Polaris investment philosophy and process. At its core, the investment philosophy is dedicated to pure global value investing — time-tested over more than four decades. We seek to build value portfolios that can achieve higher than benchmark returns with below market risk. Find out more about our investment philosophy.

- GLOBAL DIVERSIFICATION: We have a disciplined approach to global value investing, with the flexibility to invest in companies in any country (developed or emerging), industry or market capitalization. Diversification extends to more than 15 industry groups and 15 countries. Most investments are held for three to five years, and turnover averages 30% annually.

- FUNDAMENTAL STOCK PICKING: We conduct bottom-up stock selection, which results in holdings that are considered the most undervalued in the world pursuant to our valuation criteria. In addition to financial analyses, our nine-member research team assesses industry conditions, competitive advantages, profitability, operating and financial leverage and the quality of company management.

- TENURED INVESTMENT TEAM: Experience and history are hallmarks of good global investment management. The Polaris team has 150+ years of collective industry expertise, led by Bernie Horn who has been in investment management since the early 1980s. The other portfolio managers bring decades of experience to the table, supported by senior investment analysts with long standing at the firm. (see the biographies of our team)

- INVESTED ALONGSIDE OUR CLIENTS: Our personnel, from portfolio managers to analysts to relationship managers to client service, have invested a significant amount of their personal assets in the funds we manage or subadvise.

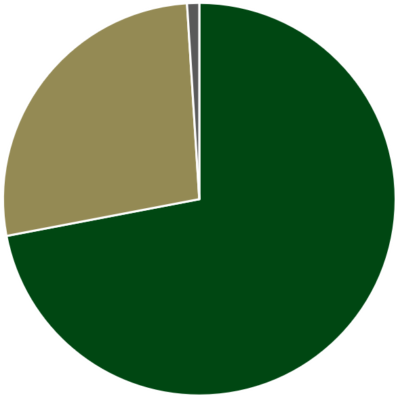

ASSETS UNDER MANAGEMENT

(as of 03/31/24)

INTL: 73% GLOBAL: 26% U.S.: 1%